Omnicore Digital Banking Experience Centre

Omnicore Digital Solutions redefines IT partnerships with bespoke tech solutions, boosting productivity, streamlining operations, and inspiring creativity.

Discover Our Products

Omnicore Digital Solutions redefines IT partnerships with bespoke tech solutions, boosting productivity, streamlining operations, and inspiring creativity.

RBX – Retail Banking Experience

RBX – Retail Banking Experience on both mobile and internet banking platforms transforms how banks interact with customers by combining cutting-edge technology with a customer-centric approach. It provides a holistic, intuitive, and secure banking ecosystem that boosts customer satisfaction, enhances operational efficiency, and ensures your bank remains competitive in today’s fast-evolving digital landscape. By integrating AI into every aspect of the banking experience, from personalized services to fraud prevention, RBX empowers banks to deliver innovative, secure, and scalable services that meet the evolving needs of customers.

Whether you’re modernizing your existing retail banking services or creating a new, digital-first experience, RBX provides the tools, technology, and AI-powered insights to drive growth and customer satisfaction. By adopting RBX, you’re not just optimizing banking operations — you’re enhancing the entire customer journey, increasing loyalty, and positioning your institution for long-term success RBX – The next-generation retail banking experience, built to drive the future of finance.

CBX – Corporate Banking Experience

CBX – Corporate Banking Experience transforms the way businesses interact with their financial operations, offering a secure, scalable, and highly efficient solution to meet the needs of modern enterprises. From small businesses to large multinational corporations, CBX equips your business with the tools it needs to streamline payments, optimize cash flow, reduce risks, and improve overall financial management. By leveraging the power of CBX, your business can benefit from seamless account management, real-time financial insights, and custom-built banking solutions that are designed to drive growth, efficiency, and long-term success. CBX – The future of corporate banking, designed for modern businesses, delivering intelligent, secure, and scalable solutions.

Blogic – Business Rule Engine

By leveraging AI-powered business rules and real-time decision-making, bLogic enhances your bank’s ability to provide fast, personalized, and secure banking experiences for customers, whether they are retail clients or corporate businesses.

bLogic, our powerful Business Rule Engine , seamlessly integrates with both RBX (Retail Banking Experience) and CBX (Corporate Banking Experience), enabling banks to enhance operational efficiency, improve customer service, and ensure compliance — all while automating critical processes. It automates complex business processes across retail and corporate banking, streamlining operations and reducing manual intervention.

Fully integrated with RBX and CBX, bLogic provides real-time automation of business rules directly within the digital banking experience. bLogic – Empowering Digital Banking with Intelligent Automation

e-Bank – NextGen Customer Onboarding

e-Bank’s Digital Customer Onboarding solution integrates seamlessly with your existing core banking systems, CRMs, and identity management platforms. This ensures that all customer information is synchronized across platforms, creating a unified customer profile from the outset.

Whether serving individual retail customers or large corporate clients, e-Bank’s innovative onboarding platform enhances the customer experience, reduces operational costs, and ensures compliance across all digital channels, on both mobile and internet banking platforms.

-Bank uses OCR using advanced AI & deep learning models for document verification to instantly and accurately authenticate documents such as government-issued IDs. e-Bank ensures the safety of personal and sensitive data through encryption and secure cloud storage. The solution is fully compliant with international data protection regulations, including GDPR, PCI DSS, and KYC (Know Your Customer), safeguarding customer information at every stage.

Payhub – Payment Gateway

Whether you're handling large-scale corporate transactions or managing government payments, PayHub offers a secure, scalable, and reliable platform that simplifies payment operations, enhances efficiency, and ensures compliance with regulatory standards.

PayHub is the ultimate solution for businesses and government organizations seeking an efficient, secure, and fully-integrated payment gateway aggregator. Designed to streamline payment processing, PayHub enables seamless transactions across multiple channels while ensuring scalability and security.

Key Features of PayHub

Dynamic Payment Routing

Real-Time Reconciliation

Seamless ERP Integration

Settlement Management

Elevate your payment processing experience with PayHub — the all-in-one payment gateway solution designed for modern businesses and government organizations.

Across Continents, Innovation Without Borders

1.2K+

Users Globally

4+

Countries Served

50+

Employees Worldwide

7+

Years in Business

10+

Product

News and Insights

Stay ahead with Omnicore Digital Solutions. Access expert insights, trends, and analysis in tech. Keep your business future-ready with our curated IT solutions and strategies.

Transform Your Digital Banking with Omnicore Digital Solutions

In today’s fast-paced world, businesses need to stay ahead of the curve, especially when it comes to digital banking solutions. At Omnicore Digital Solutions, we are committed to driving innovation that empowers financial institutions and enterprises to reach new heights. Here’s a closer look at what we offer:

🌐 Key Features of Our Solutions

🔹 Luna DuoAI - AI-Powered Chatbot A game-changer for customer interactions, Luna DuoAI offers:

- Multi-language Support for global engagement 🌍

- Voice-to-Text for quicker, more natural communication 🎙️

- 24/7 Availability to boost customer satisfaction and reduce response times ⏱️

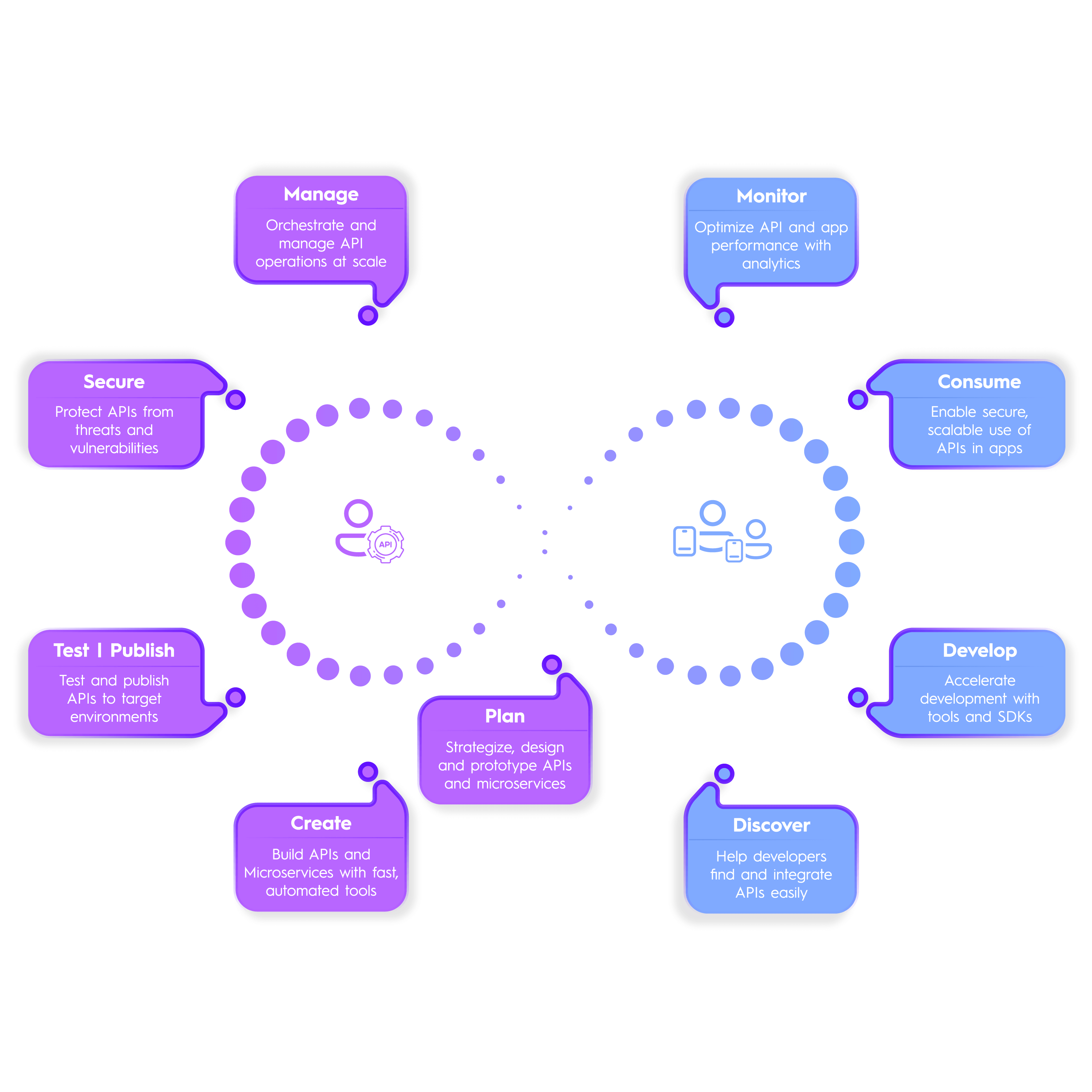

🔹 ConnectIQ - Seamless API Management Take control of your enterprise API infrastructure:

- No-code API Builder for quick integrations with minimal technical knowledge 🛠️

- Real-time API Monitoring for better performance and troubleshooting 📊

- Scalable & Secure to meet the needs of growing businesses 🔐

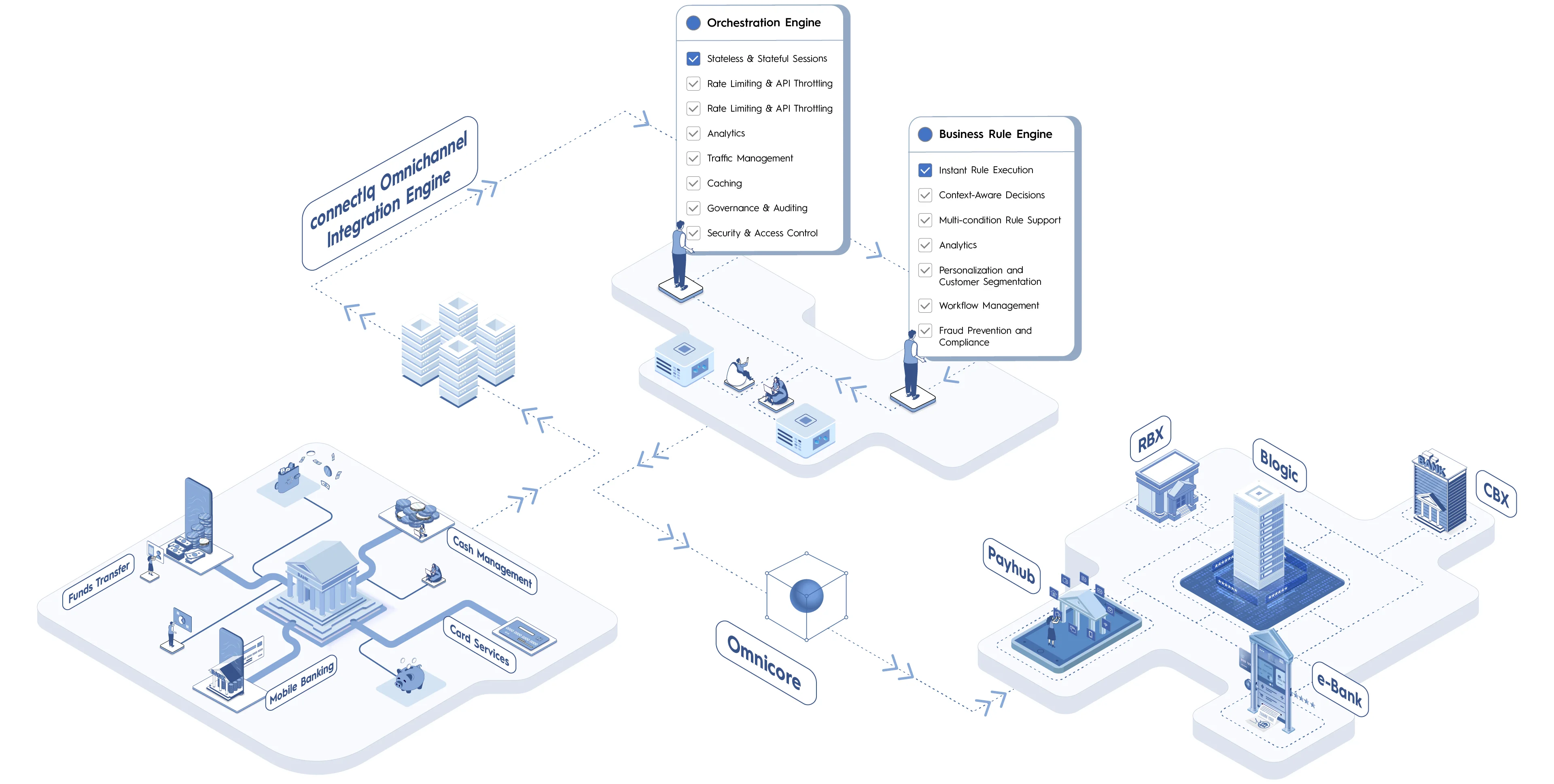

🔹 Omnicore DBX Suite - Revolutionizing Banking Our Omnicore DBX suite is designed to enhance the digital banking experience:

- Omnicore RBX for Retail Banking: Personalized services, real-time transaction updates, and seamless digital experiences 🏦

- Omnicore CBX for Corporate Banking: Streamlined solutions for corporate clients with better data analytics and enhanced security 💼

- Omnicore PayHub: Simplify your payment processes with global payment integration 💳

- Omnicore BLogic: Automate your banking workflows with ease 🛠️

📈 Case Study: Transforming a Retail Bank’s Customer Service

We partnered with Bank, a leading retail bank, to improve their customer service experience. By implementing Luna DuoAI, they were able to:

- Reduce response times by 40% with AI-powered chat capabilities

- Improve customer satisfaction by 30% through 24/7, multilingual support

- Decrease operational costs by automating routine inquiries and tasks

The results? A smoother, faster service that keeps customers happy while driving down operational overhead.

Why Choose Omnicore?

- Cutting-Edge Technology: Stay ahead with AI and advanced analytics.

- Custom Solutions: Tailored to your specific business needs.

- Secure & Scalable: Our solutions grow with you, offering enhanced security and scalability.

- Seamless Integration: Easily integrate with your existing infrastructure and processes.

📅 Ready to take your business to the next level? Let’s discuss how our digital banking solutions can transform your organization. Connect with us today to explore the possibilities!

#DigitalBanking #FinTech #AI #BankingInnovation #OmnicoreSolutions #APIManagement #CustomerExperience #EnterpriseSolutions

? Omnicore Digital Solutions: Pioneering Transformation in Banking and Enterprise Industries ?

The digital landscape is evolving faster than ever, and businesses must embrace innovation to stay competitive. At Omnicore Digital Solutions, we are at the forefront of this transformation, empowering banking and enterprise industries with cutting-edge products designed to revolutionize operations and customer experiences.

Unleashing the Power of Innovation

Our suite of products, including the Omnicore DBX Suite with its specialized components like Omnicore RBX, Omnicore CBX, and Omnicore PayHub, is tailored to address the unique challenges faced by modern businesses. These solutions are more than just tools—they are strategic enablers that:

- Enhance operational efficiency through seamless integration and automation.

- Elevate customer experiences with intuitive interfaces and responsive services.

- Ensure compliance with ever-evolving regulations.

By leveraging AI, machine learning, and cloud technologies, our solutions help organizations unlock new levels of performance and growth.

Key Areas for a Robust Product

Creating a product that supports industries as complex as banking and enterprise requires meticulous attention to several critical areas:

- Security:

- Validation and Accuracy:

- Scalability:

- User-Centric Design:

- Integration Capability:

- Performance and Reliability:

Building Awareness: What Makes a Product Exceptional?

In industries like banking, where trust and precision are everything, the qualities of a product can define its success. An exceptional product should:

- Prioritize security and compliance to build confidence.

- Be adaptable and future-ready, with built-in scalability and AI capabilities.

- Provide seamless interoperability, integrating effortlessly with legacy systems.

- Deliver value by solving real-world problems effectively and efficiently.

At Omnicore Digital Solutions, we don't just create products—we craft solutions that empower businesses to thrive in a digital-first world. Let's work together to redefine what's possible.

#Innovation #DigitalTransformation #BankingTechnology #EnterpriseSolutions #OmnicoreDigitalSolutions

Revolutionizing Retail Banking with Omnicore RBX: Transforming the Customer Experience

In the fast-paced world of modern finance, retail banks are constantly seeking innovative solutions to enhance customer experience, improve operational efficiency, and stay ahead of the competition. With customers demanding more personalized services, seamless transactions, and enhanced security, the traditional methods of banking are no longer enough. This is where Omnicore RBX steps in — a next-generation retail banking solution designed to meet the challenges of the digital age.

What is Omnicore RBX?

Omnicore RBX is an innovative, robust, and scalable platform that is revolutionizing the way retail banks operate. It provides a comprehensive suite of tools and features tailored to meet the needs of modern consumers and financial institutions. Whether it's improving online banking experiences, streamlining customer interactions, or ensuring seamless integration with third-party services, Omnicore RBX is designed to empower retail banks to offer cutting-edge digital services.

Key Features of Omnicore RBX: Empowering Retail Banks

- Seamless Customer Experience With the growing reliance on mobile and digital banking, customer expectations have shifted. They demand easy-to-use interfaces, real-time access to their accounts, and a smooth, efficient banking experience. Omnicore RBX offers an intuitive user interface and streamlined workflows that allow customers to manage their accounts, make transactions, and access services with minimal effort. The platform's focus on user-centered design ensures that all features are easy to navigate, providing an unmatched experience for retail bank customers.

- Real-Time Analytics & Decision Making In today's competitive banking environment, data is king. Omnicore RBX leverages advanced analytics and artificial intelligence (AI) to deliver real-time insights into customer behavior, account activity, and transaction history. This enables retail banks to make data-driven decisions that are based on real-time information, improving risk management, fraud detection, and customer satisfaction.

- Multi-Channel Accessibility Consumers now expect to access their banking services through a variety of channels, including web, mobile apps, and voice assistants. Omnicore RBX is designed to provide seamless cross-channel support, allowing customers to interact with their bank via multiple touchpoints. Whether they are using a smartphone app to check their balance, making a payment via an online banking portal, or using voice commands to inquire about their account, Omnicore RBX ensures a consistent and hassle-free experience across all devices.

- Enhanced Security With the increasing prevalence of cyber threats, security is a top priority for both banks and their customers. Omnicore RBX incorporates robust security features such as multi-factor authentication (MFA), encryption, and fraud detection systems to ensure that sensitive financial data remains protected at all times. Additionally, the platform is designed to comply with the highest industry standards and regulatory requirements, providing peace of mind to both banks and their customers.

- Customizable Solutions for Personalization Retail banking customers expect a personalized experience tailored to their specific financial needs. Omnicore RBX allows banks to offer a range of customizable features, such as personalized offers, loan products, and financial insights. By leveraging AI-driven recommendations and customer data, Omnicore RBX helps banks deliver highly targeted services that enhance customer loyalty and engagement.

The Challenges Omnicore RBX Solves for Retail Banks

In addition to offering powerful features, Omnicore RBX is designed to solve some of the biggest challenges facing retail banks today. These challenges include:

1. Slow and Inefficient Processes

Traditional banking processes, such as manually reviewing loan applications or processing transactions, can be slow, inefficient, and prone to human error. Omnicore RBX automates many of these processes, reducing operational costs and speeding up transaction times. For example, by automating credit scoring and loan approval workflows, retail banks can significantly reduce the time it takes to approve loans and disburse funds, improving customer satisfaction.

2. Lack of Personalization

Customers today expect more than just a basic banking service; they want banks to understand their individual needs and provide personalized offerings. Omnicore RBX helps retail banks create a highly personalized experience for their customers by using AI and machine learning to analyze customer data and offer tailored products and services.

3. Fragmented Customer Experience

With multiple digital touchpoints (online banking, mobile apps, ATMs, etc.), retail banks often struggle to provide a consistent customer experience across channels. Omnicore RBX ensures a unified, cross-channel experience by seamlessly integrating all banking channels into one platform. Whether a customer is using the mobile app, logging into their online account, or visiting a branch, they will have a consistent and seamless experience.

4. Security Concerns

With rising cyber threats, banks must take every precaution to protect customer data. Omnicore RBX incorporates best-in-class security protocols, such as encryption, secure transaction processing, and fraud detection, to ensure that all transactions are safe and secure. It also helps banks comply with regulatory requirements, such as GDPR and PCI-DSS, which are crucial for maintaining customer trust.

How Omnicore RBX is Transforming Retail Banking in Key Markets

As Omnicore Digital Solutions continues to expand its presence in global markets, its impact on retail banking is increasingly evident in regions like the UAE, India, Brazil, and Qatar.

- UAE: In the UAE, where the banking sector is rapidly embracing digital transformation, Omnicore RBX is helping retail banks cater to the tech-savvy population by providing secure, mobile-first banking solutions. The UAE’s growing fintech landscape is benefiting from Omnicore’s seamless integration with new technologies and APIs, providing local banks with the tools they need to offer cutting-edge services.

- India: India’s retail banking sector is undergoing a massive digital shift, with millions of new users gaining access to banking services through mobile phones. Omnicore RBX is playing a key role in this transformation by enabling Indian banks to offer affordable, accessible, and secure banking solutions to their rapidly growing customer base. With features like mobile banking apps and digital wallets, Omnicore RBX helps financial institutions reach customers in even the most remote areas.

- Brazil: Brazil, one of the largest economies in South America, is also seeing a surge in digital banking adoption. Omnicore RBX is helping Brazilian banks overcome challenges related to customer engagement, financial inclusion, and transaction speed. By leveraging Omnicore’s advanced analytics and AI capabilities, Brazilian banks are able to offer more personalized services and faster processing times, providing customers with a superior banking experience.

- Qatar: Qatar's growing digital economy is driving demand for sophisticated retail banking solutions. Omnicore RBX is helping Qatari banks meet this demand by offering secure, mobile-first solutions that enable customers to access their accounts and perform transactions on the go. With a focus on security and ease of use, Omnicore RBX is helping Qatar’s banks maintain their competitive edge in the fast-evolving financial landscape.

Conclusion: Why Choose Omnicore RBX for Your Retail Bank?

As the banking industry continues to evolve, it is essential for retail banks to stay ahead of the curve by adopting innovative solutions like Omnicore RBX. With its advanced features, seamless user experience, and ability to solve key challenges in the retail banking sector, Omnicore RBX is the ultimate solution for banks looking to thrive in the digital era.

By embracing Omnicore RBX, retail banks can improve customer engagement, streamline operations, and enhance security, positioning themselves for success in an increasingly digital world. Whether you are a bank based in the UAE, India, Brazil, or Qatar, Omnicore RBX is the platform you need to drive your digital transformation journey forward.

Corporate Banking Reimagined with Omnicore CBX: A New Era of Efficiency and Security

Corporate banking is the backbone of every successful business, whether large or small. As industries continue to evolve in the digital age, the demands placed on corporate banking systems have drastically shifted. In today’s competitive landscape, businesses require faster, more secure, and more efficient banking solutions that can cater to their complex financial needs. Omnicore CBX is here to revolutionize corporate banking by offering an advanced, flexible platform that addresses these challenges head-on.

Omnicore CBX is not just a banking tool; it’s a comprehensive, end-to-end solution designed to transform how businesses handle their financial transactions, manage their accounts, and collaborate with financial institutions. Let’s explore how Omnicore CBX is reshaping corporate banking for the modern enterprise.

What is Omnicore CBX?

Omnicore CBX is an innovative Corporate Banking Experience platform that provides businesses with a comprehensive suite of tools designed to streamline banking operations. Whether it's enabling seamless fund transfers, managing multi-currency accounts, providing real-time reporting, or ensuring top-notch security, Omnicore CBX empowers businesses with the tools they need to succeed in the digital era.

The platform allows corporate clients to manage all their banking activities, collaborate with various stakeholders, and maintain compliance effortlessly. With a focus on scalability and customization, Omnicore CBX ensures that it meets the unique needs of businesses, from small enterprises to multinational corporations.

Key Features of Omnicore CBX: Empowering Corporate Banking

- Multi-Currency and Cross-Border Transactions Corporate banking is not limited to just one currency or one geographic location. Businesses operate on a global scale and often need to manage transactions in multiple currencies. Omnicore CBX makes it easy to manage these complex transactions with its multi-currency capabilities. Whether a company is doing business in the US, Europe, or Asia, Omnicore CBX supports seamless, real-time cross-border transactions with low conversion fees and immediate processing.

- Enhanced Security and Fraud Prevention Security is paramount when it comes to corporate banking. Omnicore CBX incorporates advanced security features like multi-factor authentication (MFA), end-to-end encryption, and fraud detection systems to protect sensitive corporate data. With these robust security measures in place, businesses can rest assured that their financial information and transactions are safe from cyber threats.

- Real-Time Analytics and Reporting Businesses today rely on real-time data to make informed decisions. Omnicore CBX offers powerful analytics tools that provide real-time reports on cash flow, account balances, transaction histories, and financial performance. This level of visibility allows business owners and financial managers to track their financial health in real-time, enabling smarter decision-making and better management of funds.

- Customizable Solutions for Tailored Experiences Every business is different, and corporate banking solutions should reflect that. Omnicore CBX offers customizable solutions that can be tailored to a company’s specific needs. Whether it's automated reporting, customized transaction limits, or flexible user permissions, Omnicore CBX adapts to the unique requirements of each business, ensuring a smooth and efficient banking experience.

- Seamless Integration with Third-Party Services Omnicore CBX is designed with integration in mind. The platform allows businesses to easily connect with third-party financial services, accounting tools, ERP systems, and other business applications. This integration capability eliminates silos in financial operations and helps businesses streamline their processes, saving both time and money.

How Omnicore CBX Solves Key Challenges in Corporate Banking

Corporate banking presents several unique challenges that traditional banking systems often fail to address effectively. Let’s take a look at how Omnicore CBX tackles these challenges:

1. Complex and Slow Transaction Processes

Traditional corporate banking systems often involve cumbersome, slow, and error-prone transaction processes. This can lead to significant delays in processing payments, which can negatively affect cash flow and business operations. Omnicore CBX automates many of these processes, ensuring that transactions are completed quickly and accurately. Cross-border payments are processed seamlessly, without the usual delays, allowing businesses to focus on their growth rather than managing transactional inefficiencies.

2. Limited Access to Financial Insights

Many businesses struggle to gain real-time insights into their financial health. Without comprehensive reporting tools, it’s challenging for decision-makers to understand the impact of financial activities and make data-driven decisions. Omnicore CBX provides businesses with instant access to detailed, real-time analytics and reports. This helps business owners and financial managers gain full visibility into their financial situation, facilitating better forecasting, budgeting, and cash flow management.

3. Security Risks and Compliance Concerns

With increasing cyber threats, businesses are more vulnerable than ever to security breaches and financial fraud. In addition to these risks, they must also ensure compliance with industry regulations, such as AML (Anti-Money Laundering) and KYC (Know Your Customer) requirements. Omnicore CBX is equipped with high-level encryption, automated fraud detection, and built-in compliance features that ensure both data protection and regulatory adherence, giving businesses peace of mind.

4. Lack of Flexibility and Scalability

As businesses grow, their banking needs evolve. Traditional banking systems often lack the flexibility and scalability needed to meet these changing demands. Omnicore CBX is designed to grow with your business. Its modular architecture means that as your business expands, Omnicore CBX can be customized to accommodate new financial products, services, and markets. Whether you're expanding locally or globally, Omnicore CBX provides the scalability to handle complex banking needs.

How Omnicore CBX is Transforming Corporate Banking Globally

As Omnicore CBX continues to make waves in corporate banking, its impact is being felt in key markets around the world, including Poland, Brazil, Egypt, and Qatar.

- Poland: Poland’s fast-growing economy has a thriving corporate sector, but it also faces the challenge of modernizing financial services to keep pace with the digital transformation. Omnicore CBX is helping Polish businesses streamline their banking processes and overcome challenges related to cross-border transactions, regulatory compliance, and financial reporting. The platform’s integration with third-party services has made it easier for businesses in Poland to manage their finances and improve operational efficiency.

- Brazil: As Brazil's corporate landscape becomes more interconnected globally, the demand for secure, efficient, and scalable banking solutions has never been higher. Omnicore CBX is supporting Brazilian businesses by providing them with advanced tools for currency management, secure cross-border transactions, and real-time financial analytics. Brazilian companies are leveraging Omnicore CBX to boost their competitiveness in both local and international markets.

- Egypt: Egypt is experiencing a surge in corporate banking adoption, with businesses needing smarter and more flexible financial solutions. Omnicore CBX is playing a key role in this transformation by providing Egyptian businesses with the tools they need to manage multiple accounts, track expenses, and ensure compliance. By implementing Omnicore CBX, Egyptian banks are improving service delivery, and businesses are benefitting from smoother, more secure transactions.

- Qatar: Qatar’s corporate banking sector is evolving rapidly, with a growing demand for digital solutions that simplify banking operations. Omnicore CBX helps businesses in Qatar handle complex financial transactions with ease. With its advanced security features and real-time reporting tools, Omnicore CBX enables businesses to streamline their banking processes and make faster, informed decisions.

Conclusion: Why Omnicore CBX is the Future of Corporate Banking

Omnicore CBX is not just a platform; it's a game-changer for corporate banking. With its advanced features, focus on security, and ability to streamline banking operations, Omnicore CBX is empowering businesses around the world to take control of their financial futures. Whether you're a small enterprise or a large corporation, Omnicore CBX provides the tools you need to stay competitive, secure, and efficient.

By choosing Omnicore CBX, businesses can overcome the traditional pain points of corporate banking, from slow transaction times and lack of insights to security risks and limited scalability. As the corporate banking landscape continues to evolve, Omnicore CBX is helping businesses navigate these changes with ease, ensuring that they are always ahead of the curve.

If you're ready to embrace the future of corporate banking, Omnicore CBX is here to make that journey smooth, secure, and successful.